Like any other professionals, doctors face numerous challenges when expanding or upgrading their practice. One of the significant challenges they encounter is the need for access to funding to support their business endeavours. This is where lending specialists for doctors come in. These professionals specialise in providing financial solutions and support to medical practitioners to help them grow and develop their practices. Be it offering medical equipment finance or guidance to branch out. This article will explore how lending specialists can help doctors expand or upgrade their practice.

Understanding Lending Specialists for Doctors

Before going into how such specialists can help doctors, it is essential to understand who they are and what they do. Lending specialists for doctors provide financial support to medical practitioners in various forms. They work with banks, credit unions, and other financial institutions to help doctors secure funding for their business endeavours. These specialists have an in-depth knowledge of the medical industry and understand the unique financial needs and challenges medical practitioners face.

Types of Financial Solutions Provided by Lending Specialists

Lending specialists for doctors offer various financial solutions to help medical practitioners expand or upgrade their practice. Some of these solutions include:

- Business Loans: Providing business loans to doctors to help them purchase new equipment, expand their premises, or hire new staff. These loans can be tailored to suit the specific needs of the medical practitioner and can be paid back over an agreed period.

- Practice Acquisition Loans: These loans are designed to help doctors acquire an existing practice or merge with another practice. Lending specialists provide the funding needed to complete the acquisition, which is then paid back over an agreed period.

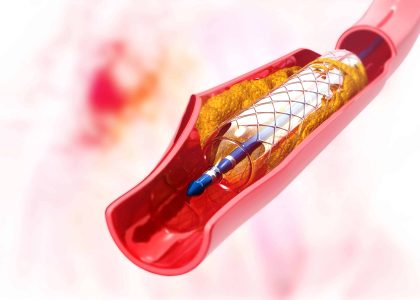

- Equipment Financing: Medical equipment can be expensive, and doctors may need help to afford the latest technology. Lending specialists provide financing options to help doctors purchase or upgrade new equipment.

- Line of Credit: A line of credit is a flexible financing option that allows doctors to access funds when needed. This type of financing can be used to cover unexpected expenses or to take advantage of business opportunities as they arise.

Benefits of Using Lending Specialists

Using lending specialists for doctors has numerous benefits. Some of these benefits include:

- Access to Funding: The primary benefit is access to funding. These professionals work with financial institutions to secure funding for doctors, making it easier for them to expand or upgrade their practice.

- Competitive Rates: They have access to a range of financial products and can negotiate competitive rates on behalf of their clients. This means doctors can access funding at a lower cost than if they were to approach financial institutions directly.

- Expert Advice: Their in-depth knowledge of the medical industry helps provide expert advice on the best medical equipment finance and practices.

- Tailored Solutions: These experts can tailor financial solutions to suit the specific needs of a medical practitioner. It means doctors can access funding that is tailored to their business requirements.

- Time-Saving: This possibility saves doctors time as they do not need to research and negotiate with financial institutions. The lending specialist takes care of this on their behalf.

Summing Up

With the support of lending specialists, doctors can focus on providing high-quality care to their patients while growing their businesses. If you are a medical practitioner looking to expand or upgrade your practice, consider working with a lending specialist to explore your financial options and achieve your goals.